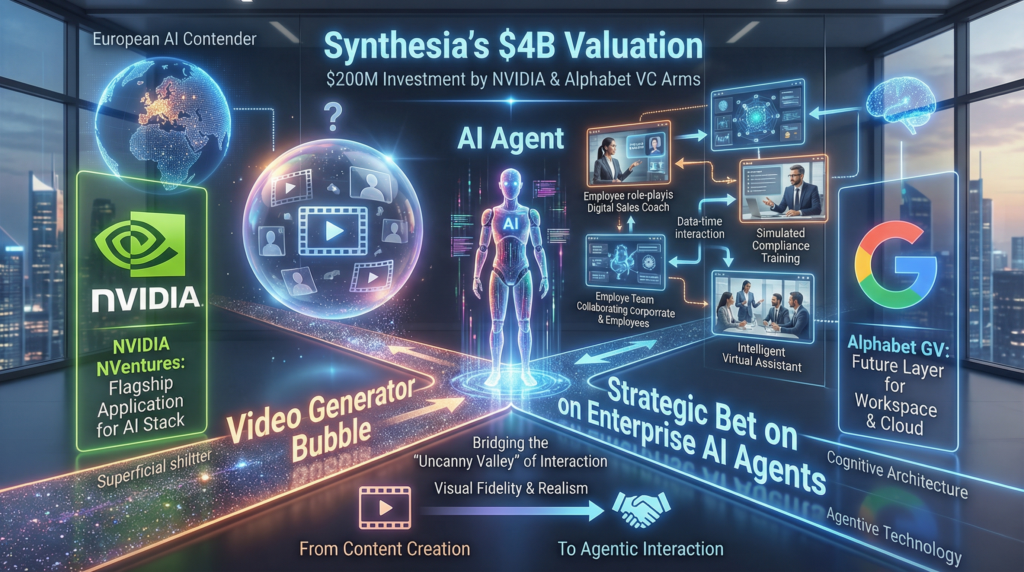

Synthesia’s $4B Valuation: Strategic Bet on Enterprise AI Agents or Video Generator Bubble?

https://www.cnbc.com/2026/01/26/nvidia-alphabet-vc-arms-back-synthesia.html

The $200 million investment from Nvidia and Alphabet’s VC arms has catapulted the AI video startup Synthesia to a $4 billion valuation. But beyond the headline-grabbing numbers lies a deeper strategic play: this isn’t just funding for better avatars; it’s a calculated wager that the future of enterprise software is interactive, agent-driven communication.

In a market saturated with generative AI for text and images, Synthesia is attempting a pivot from a content creation tool to a platform for AI-driven human interaction. This analysis breaks down the strategy, technology, product evolution, and market forces at the intersection of this major deal.

The Strategic Pivot: From Video Generation to “Agentic” Interaction

Synthesia’s latest funding round is strategically distinct. CEO Victor Riparbelli frames it as scaling a vision where AI reduces content creation costs, but the capital is earmarked for a critical evolution: “agentic capabilities within the videos.”

This signals a fundamental shift from a generative tool to an interactive platform. The goal is no longer to produce a training video but to create a simulated environment where an employee can converse with an AI manager, practice a sales pitch with a reactive AI customer, or explore different decision paths in a compliance scenario. This moves Synthesia’s product from the “content” budget line to the core “productivity and training” infrastructure of an enterprise.

The backing from Nvidia’s NVentures and Alphabet’s GV is highly strategic. It’s not merely financial validation; it’s alignment with the ecosystem giants betting on the future of AI agents. NVIDIA gains a flagship enterprise application for its hardware and AI software stacks, while Alphabet (Google) integrates a potential future layer for Workspace, Cloud, or its own agent ambitions.

Technology & Product: Bridging the “Uncanny Valley” of Interaction

Synthesia’s technical challenge is monumental. It must advance on two parallel fronts:

- Visual Fidelity & Realism: Continuing to improve its hyper-realistic AI avatars and scenes to maintain credibility.

- Cognitive Architecture: Building the underlying AI models that can power realistic, context-aware, and helpful conversations within a defined professional domain.

The product promise—allowing employees to “explore scenarios through role-play and receive tailored explanations”—positions it against traditional e-learning platforms and costly in-person training. However, the risk is an “uncanny valley of interaction”: avatars that look real but whose conversations feel scripted, shallow, or unhelpful. The technology must deliver not just a talking head, but a perceptive, knowledge-guided agent.

Timing the Enterprise Upskilling Wave

Synthesia is betting on a powerful convergence, as noted by Riparbelli: a technology shift (capable AI agents) meets a market shift (board-level priority on upskilling). Enterprises globally are desperate for scalable solutions to train workforces on constantly evolving processes, software, and regulations.

With $150 million in Annual Recurring Revenue (ARR) and on track to reach $200 million, Synthesia has proven there’s a market for AI video. The new valuation is based on the belief that the market for interactive AI agents will be an order of magnitude larger. They are competing not just with other AI video tools, but with the future roadmaps of giants like Microsoft (Copilot), Salesforce (Einstein), and SAP, all of which are embedding agentic AI into their platforms.

The European AI Contender in a U.S.-Dominated Field

This funding also highlights Europe’s strong position in the AI race. As the article notes, European AI startups raised a record $21.4 billion in 2025, though still dwarfed by the U.S. Synthesia, a “UK success story” championed by politicians, represents a rare non-U.S. contender achieving “unicorn-plus” status in a field dominated by OpenAI, Anthropic, and xAI.

Its focus on a specific, monetizable enterprise application (communication/training) rather than foundational model development may be its strategic insulation. In a market where U.S. giants are spending tens of billions on compute and research, Synthesia’s applied, product-centric path could be a sustainable model for European AI.

Critical Challenges & The Road Ahead

The $4 billion valuation sets extremely high expectations. Synthesia must now:

- Successfully execute the technological pivot to robust “agentic” AI, a problem even the largest labs are still solving.

- Defend against platform encroachment as major enterprise software suites build or buy similar capabilities.

- Scale its sales and implementation to justify the valuation premium, moving from early adopters to mainstream enterprise adoption.

- Navigate the ethical and practical minefield of deepfake technology and AI-led communication, ensuring trust remains central.

Let’s consider the Brass tacks: Nvidia and Alphabet aren’t just betting on a better video generator. They are investing in a strategic beachhead for AI agents in the enterprise. Synthesia’s journey from video synthesis to interaction synthesis will be a key test case for whether specialized AI applications can build durable, transformative businesses—or if they are merely features waiting to be absorbed by the next platform wave. The $4 billion question is: Are they building the future of enterprise training, or an advanced prototype for a capability that will soon be ubiquitous?